How do you get a late payment removed from your credit report?

Getty Images

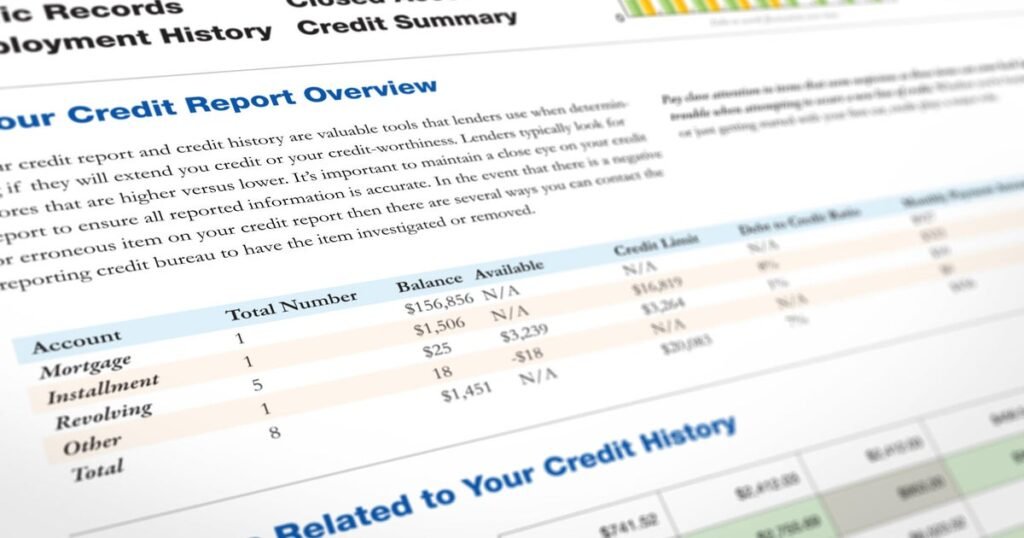

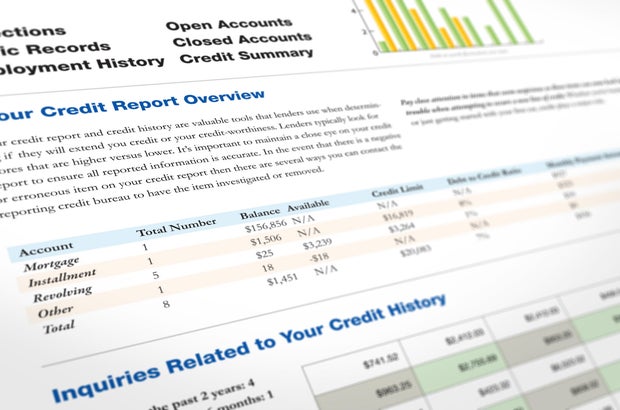

When it comes to minor financial missteps, few are as common, or as potentially damaging, as late payments on your credit report. But with sticky inflation still putting pressure on household budgets and interest rates stubbornly high, many people are stretched thinner than ever. As a result, it can be easy to push off debt payments by a few days, and then a few weeks, resulting in them slipping through the cracks over time. You may not even realize you overlooked a payment until you check your credit report and see it.

And that, in turn, could have a big impact on your finances. After all, your credit score carries serious weight. It affects everything from the rates you’re offered on loans to your ability to rent an apartment or even land certain jobs. That’s why a single late payment can feel like more than just a minor mistake. It can feel like a threat to your overall financial stability. But while late payments cause damage to your finances, they don’t have to completely define your credit future.

There are a few strategies you can use to try and remove a late payment from your credit report — or at least soften the impact. Below, we’ll outline what you can do to try to remove a late payment from your credit report to get things back on track.

Find out how to take control of your high-rate debt today.

How do you get a late payment removed from your credit report?

Before you take any action, it’s important to determine whether the late payment listed on your credit report is legitimate, meaning that you really did miss the due date. If you take steps to verify the late payment and determine that it’s valid, credit bureaus are generally under no obligation to remove it. That doesn’t mean you’re out of options, though. Here are some of the approaches you can use to try to get a late payment off your report:

Request a goodwill adjustment. If you have a strong payment history and this is a one-time slip, you can write a goodwill letter to the credit card company or lender. In this letter, you typically acknowledge the late payment, explain why it happened (for example, a medical emergency, temporary hardship or simple oversight) and ask them to remove the negative mark as a gesture of goodwill. Some creditors are willing to do this, especially if you’ve been a reliable customer.

Dispute inaccuracies. If you believe the late payment is an error — maybe you were never late or the payment was marked late by mistake — you have the right to file a dispute. You can submit disputes to the major credit bureaus (Equifax, Experian and TransUnion) online or by mail. You’ll need to provide documentation, such as bank statements or payment confirmations, to back up your claim, but if the bureau finds that the information is incorrect, they must remove it.

Negotiate with your creditor. You may be able to negotiate directly with the creditor to remove the late payment from your report, especially if you’re willing to take action in return. For example, you might offer to enroll in autopay, pay off a past-due balance or bring an account current in exchange for the removal of the late mark. This type of negotiation is known as a “pay for delete.” Not all creditors will agree to do this, but it’s worth asking.

Wait it out. If none of the above approaches work, you may just need to wait it out. Late payments stay on your credit report for up to seven years, but the impact that a late payment has on your score lessens over time. Consistently making on-time payments after a late mark can help your credit recover faster.

Explore your debt relief options and get your finances back on track now.

How a late payment can affect your credit score

Late payments aren’t just a small ding on your record. They can have a surprisingly big impact, especially if you have an otherwise clean credit history. Here’s what you need to know about the potential impacts:

- How much it can hurt: Your payment history makes up about 35% of your FICO credit score, making it the single most important factor. Just one late payment can cause a score drop of 50 to 100 points, depending on your overall credit profile. And, the more recent the late payment, the more damage it can do.

- How long it sticks around: A late payment can remain on your credit report for seven years from the date of the delinquency. However, the older it gets, the less weight it carries in credit score calculations.

- The other consequences: Beyond your score, late payments can lead to higher interest rates, reduced credit limits and difficulty qualifying for loans or credit cards. In some cases, they can even affect things like renting an apartment or getting approved for certain jobs, as many landlords and employers check credit reports.

The bottom line

Removing a late payment from your credit report isn’t always easy, but it’s worth trying, especially if the late mark is hurting your score or doesn’t accurately reflect your payment behavior. Start by reaching out to your creditor with a goodwill request or file a dispute if you believe there’s been a mistake. If those options don’t work, focus on rebuilding: Make every future payment on time, reduce your overall debt and be patient as your credit recovers.

You may be interested

Boden’s ‘fun and flamboyant’ £115 trousers now £40 in sale

new admin - Jun 19, 2025[ad_1] Bold patterned trousers are the perfect garment for creating an effortless statement outfit. Boden has slashed the price of…

James Bond favourite drops biggest hint yet he’ll be 007 with 5 words | Celebrity News | Showbiz & TV

new admin - Jun 19, 2025Aaron Taylor-Johnson, one of the frontrunners rumoured to replace Daniel Craig as the next James Bond, has teased fans with…

What’s open and closed on Juneteenth 2025? Find out if banks, supermarkets and other stores are operating.

new admin - Jun 19, 2025Juneteenth has arrived, with Americans now celebrating its fifth year as a federally recognized holiday. Given its relatively new status…