Will I get a tax refund if I owe money from a previous year?

Bernie_photo/Getty Images

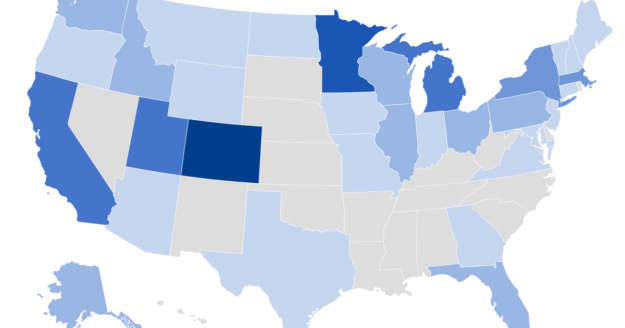

The Internal Revenue Service (IRS) processes more than 160 million tax returns every year, and each tax season, millions of Americans discover that they’re owed refunds — some of which are substantial. For many of these filers, the money from their tax refund acts as a crucial part of their budgets, allowing them to cover large expenses, put money in savings or make it easier to pay off debt or meet money goals. But if you’re owed a tax refund and are among the many taxpayers who are still carrying outstanding tax debt from previous years, you might wonder whether that refund money will actually make it to your bank account.

The IRS maintains meticulous records of what every taxpayer owes, after all, and that information follows you from year to year. So, it would be logical to conclude that any prior tax debt you have would impact whether you’re eligible to receive a tax refund in the future. However, the answer to that question isn’t as cut and dry as you may expect, as there are numerous factors — including your payment history and your current tax situation — that can impact whether you’ll see a tax refund check when you’re caught in the IRS’s collection system.

So, should you expect to receive your tax refund this year if you still owe money to the IRS for old tax debt? Or should you prepare yourself for your funds to be used to pay off what’s owed instead? That’s what we’ll examine below.

Learn how to get help with your IRS tax debt now.

Will I get a tax refund if I owe money from a previous year?

Technically, yes — you can be entitled to a tax refund even if you owe money from previous years. Your refund is calculated based solely on your current tax year’s income, deductions, withholding and credits. If you overpaid your current year’s taxes through paycheck withholding or estimated tax payments, you’ve earned that refund regardless of past debts.

However, there’s a catch: The IRS will almost certainly intercept your refund through a process called “offset.” Under the Treasury Offset Program, the IRS automatically applies any refund you’re entitled to toward any outstanding federal tax debt that accrued in years prior, and they’ll do so before sending you any money. This happens without requiring your permission or advance notice, though you should receive a letter after the offset explaining what occurred.

The math here is simple. If you’re owed a $2,500 refund but have $4,000 in back taxes, the IRS would keep your entire refund and apply it to your debt, leaving you with a $1,500 balance that still needs to be paid. Conversely, if you owe $1,000 in prior tax debt but earned a $2,500 refund, the IRS deducts $1,000 from your refund and sends you the remaining $1,500. You won’t receive any refund until your entire tax debt is satisfied.

This offset applies to any type of back taxes, whether you owe from one previous year or multiple years, and whether you’re on an IRS payment plan or not. The IRS will still seize your refund and apply it toward your remaining balance, even if you’ve been diligently making monthly installment payments.

Compare the IRS tax debt solutions available to you today.

What are your options if you owe back taxes?

If you’re facing tax debt and want to maximize your chances of seeing future refunds, you need to address the underlying balance now. Luckily, there are several options to choose from, depending on your financial situation and how much you owe.

An installment agreement, for example, allows you to pay your debt over time, though the IRS will continue offsetting refunds while you’re paying. For those experiencing genuine financial hardship, pursuing Currently Not Collectible status can temporarily pause collection activities, though interest and penalties continue accruing. If your debt exceeds your ability to ever reasonably pay, an Offer in Compromise might let you settle for less than the full amount, though the IRS only approves a percentage of these applications.

Adjusting your withholding is another strategic approach. If the IRS keeps seizing your refunds to cover old tax debt, you may want to adjust your withholdings and have less tax held from your paychecks, essentially giving yourself that money throughout the year rather than lending it to the government. Just be careful not to underwithhold so much that you create new tax debt, which would only add to your issues.

While you can pursue any one of these remedies independently, it’s worth noting that the IRS tax debt solutions, in particular, can be tough to qualify for. As a result, it often makes sense to work with a tax relief company on a resolution. These companies specialize in negotiating with the IRS on your behalf, handling paperwork and identifying which resolution option best fits your situation, and working with one can provide crucial guidance, especially for complex cases or substantial debts.

The bottom line

Owing back taxes doesn’t eliminate your eligibility for refunds, but it does virtually guarantee you won’t receive that money until your debt is cleared. The IRS’s offset program operates automatically, applying refunds toward outstanding balances regardless of any payment plans or solutions in place. So, rather than counting on refunds that may never arrive, focus on resolving your tax debt through installment agreements, settlement programs or professional tax relief services that can negotiate better terms. The sooner you address the underlying debt, the sooner you’ll start keeping your refunds instead of watching them disappear as they’re applied toward your tax debt balance.

You may be interested

Lindsey Vonn trains after ruptured ACL, eyes Olympic downhill event on Sunday

new admin - Feb 05, 2026[ad_1] Lindsey Vonn plans Olympics comeback despite ACL injury Three-time Olympic medalist Lindsey Vonn discusses her plan to compete in…

U.S. moving 7,000 ISIS suspects from Syria to Iraq amid concerns over security and due legal process

new admin - Feb 05, 2026Erbil, Iraq — The U.S. military is in the process of transferring nearly 7,000 ISIS suspects from prisons and jails in…

Here’s what Xbox is working on for 2026

new admin - Feb 05, 2026Microsoft has a big year ahead for Xbox as it marks its 25-year milestone. After the tough decision to release…