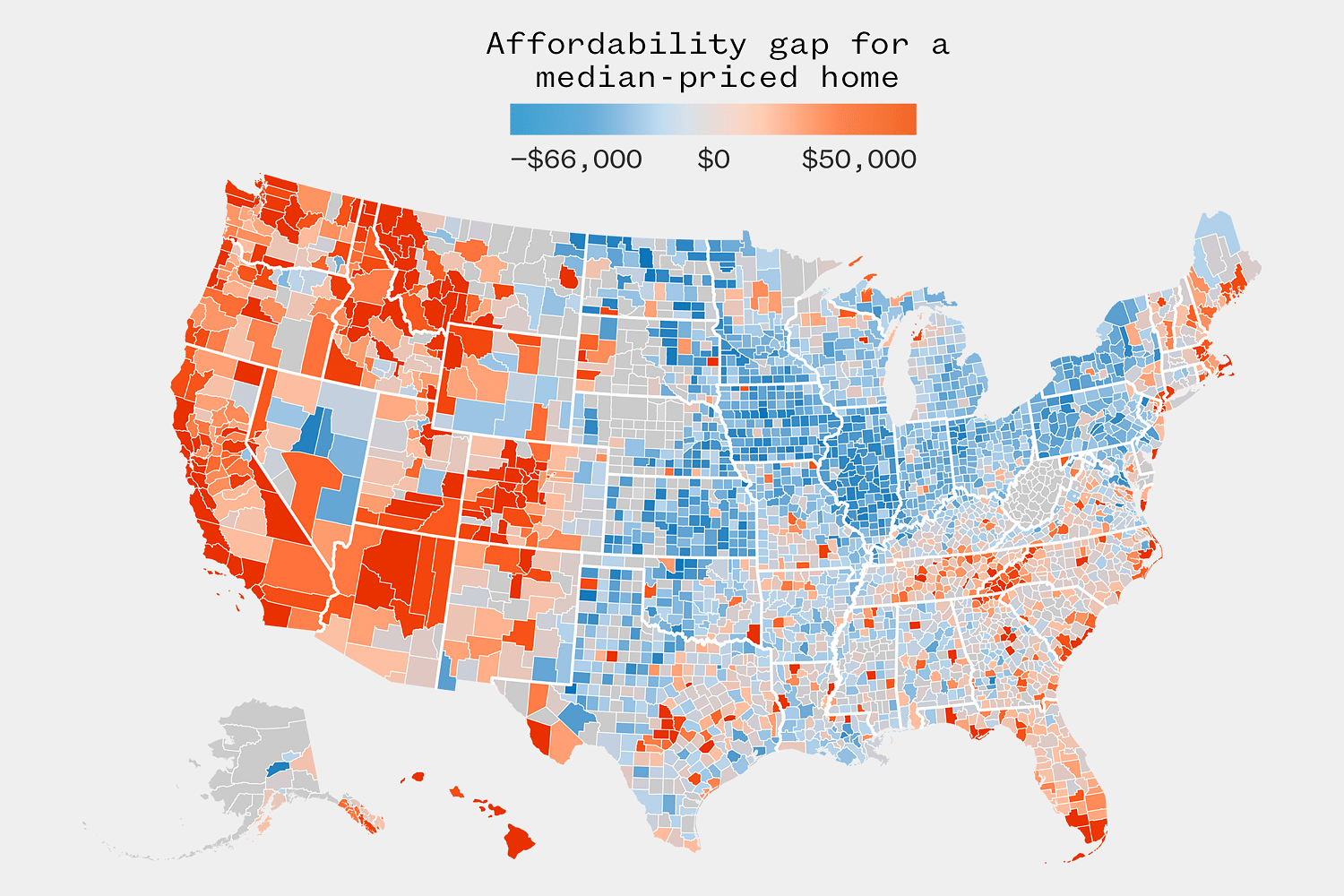

Where housing affordability is worst and costs are highest in the U.S.

In the San Francisco Bay Area county of Alameda, which includes the cities of Oakland and Alameda, the gap between what buyers can afford and what homes sell for is nearly $73,000. Alan Teague, who lived in the Bay Area for nearly 40 years and was on the city of Alameda’s planning board, said some of the region’s affordability gap can be blamed on a lack of available homes, as the pace of building is far below demand.

“The sheer cost of houses has gone up, you know, an order of magnitude in the time that I’ve been here,” Teague said. “The supply has not kept up.”

New construction would help ease the gap, Teague said, but he added that the price of building in the region remains high. “We were being told that an affordable unit costs a million dollars per unit or more,” Teague said. “That’s mind-boggling.”

Even in counties that, by the numbers, look affordable, things are shifting.

In Henry County, Indiana, east of Indianapolis, the median list price is $190,000, less than half the national median. But prices in Henry have more than doubled since 2019 — taking the county from being one of the most affordable places to buy to one where homes are edging out of reach for locals. Reflecting that, the county’s Home Buyer Cost Index increased more from 2019 to 2024 than that of any other county NBC News measured.Hart Summeier, owner of Level Up Real Estate Group, said the buyers in Henry County who are feeling squeezed the most are first-time buyers and those on fixed incomes, like the elderly. In response, Summeier said, buyers have started “biting the bullet” and accepting homes with trade-offs they wouldn’t have accepted in previous years.

“OK, I will drive 40 minutes to work each day each way to not have to pay another $1,000 more monthly to be close to my job,” he said.

Sydney Personett experienced that squeeze firsthand trying to buy a home in 2024. At the time, Personett, 24, and her husband, Tucker, were trying to buy a home somewhere east or northeast of Indianapolis. Hamilton County was “extremely expensive,” she said, which left Henry County and Hancock County.

The couple found themselves thwarted in Henry by a lack of supply, and they eventually stomached higher home payments and bought in Hancock.

“We both made a lot of sacrifices in college, kind of preparing ourselves, you know, doordashing on the side just to get in some extra cash,” Personett said. “We both knew that our end goal was to buy a home together and kind of build this life for each other.”

CORRECTION (June 11, 2024, 1:32 p.m. ET) An earlier version of this article conflated the number of years Alan Teague served on the city of Alameda’s planning board. He spent nearly 40 years in the Bay Area, not on the planning board.

You may be interested

2 Sinaloa cartel leaders, including son of “El Chapo,” arrested in Texas

new admin - Jul 27, 20242 Sinaloa cartel leaders, including son of "El Chapo," arrested in Texas - CBS News Watch CBS News Two leaders…

Former Chiefs player Isaiah Buggs sentenced in animal cruelty case

new admin - Jul 27, 2024[ad_1] Join Fox News for access to this content You have reached your maximum number of articles. Log in or…

New details reveal troubled past for deputy charged with murder in Sonya Massey shooting

new admin - Jul 27, 2024New details reveal troubled past for deputy charged with murder in Sonya Massey shooting - CBS News Watch CBS News…