Is a 29.99% APR high for a credit card?

Olha Danylenko/Getty Images

It’s hard to ignore how fast credit card rates have climbed recently, and, in turn, how expensive it now is to carry a balance from one month to the next. Credit card rates that once looked extreme are now showing up on the average cardholder’s statements, and for a growing number of borrowers, credit card APRs near 30% are no longer the exception, but the norm. That rate shift has quietly changed how credit card debt impacts borrowers’ budgets.

For example, a charge on your credit card that starts as a temporary fix or a short-term borrowing solution for a tight month can turn into a long-term drain when the compounding credit card interest charges start to accrue, ultimately stretching repayment out over years instead of months. And, the higher the credit card rate climbs, the more every swipe costs — not just today, but far into the future.

When you see a 29.99% APR attached to your credit card, though, is it worth pausing before you swipe? Or should you just shrug it off as being a common issue in today’s rate environment? That’s what we’ll discuss below.

Get expert help with your high-rate credit card debt now.

Is a 29.99% APR high for a credit card?

Short answer: Yes — a 29.99% APR is very high, even in today’s elevated-rate environment. Credit card APRs vary widely based on your credit profile, the type of card you have and current market rates. For example, rewards cards and cards marketed to people rebuilding their credit often sit at the higher end of the spectrum. But once you’re brushing up against 30%, you’re in the top tier of what mainstream credit card issuers charge.

That matters, in large part, because of how interest compounds. A 29.99% APR translates to roughly 2.5% interest per month (29.99% ÷ 12 months = 2.499% per month). That may not sound huge in isolation, but it stacks up quickly. And, when you’re carrying a revolving balance on your credit cards, you’re charged interest on the balance and the prior interest charges. On a larger balance, that math can get uncomfortable fast.

That said, many people end up with these types of credit card rates simply because of how cards are priced today, not because they’ve done anything extreme or have been bad with money. Card issuers have repriced risk aggressively over the years, and variable APRs have moved higher across the board. So, even borrowers with decent credit are seeing credit card rates they wouldn’t have imagined a few years ago.

The bigger risk isn’t just the rate itself, though. It’s what the rate does to your payoff timeline. At nearly 30%, the minimum payments tied to your balance will barely make a dent. You can be paying for months or years and still feel stuck in place. That’s when a high credit card APR stops being an annoyance and starts becoming a structural problem in your finances.

Find out what debt relief options are available to you today.

How to lower your credit card interest rates now

If your card is sitting near 29.99%, you may want to stop treating that rate as permanent. You usually have more options than it feels like if you want to lower your card rates or reduce what you owe, including the following:

Start by asking for a lower rate. It sounds basic, but simply asking for a lower rate works more often than people expect — especially if you’ve been a customer in good standing. A quick call to your card issuer to request a temporary or permanent APR reduction can shave points off your rate. Even a small drop in your rate can translate into meaningful savings if you’re carrying a balance.

Look for hardship or relief programs. Many card issuers offer internal programs for customers who are struggling to keep up with their payments. These can vary but often include temporary rate reductions, waived fees or structured payment plans. They’re not always advertised, though, so you often have to ask directly.

Use balance transfers strategically. Promotional 0% or low APR balance transfer offers can be a powerful tool to use if you have the credit to qualify and a realistic plan to pay the balance down during the promo period. The key is discipline: If the balance doesn’t move meaningfully before the promo ends, you can end up right back in high APR territory.

Consider a debt management plan. Enrolling in a debt management plan through a credit counseling agency can be a smart move if you want to consolidate multiple credit card payments into one monthly obligation while negotiating lower interest rates with your creditors. The rate reductions can drop your card rates into the single digits in many cases, making the payoff timeline far more manageable.

Explore debt settlement carefully. If your balances are overwhelming and your budget is already stretched thin, debt settlement may be another option. It’s not a fit for everyone and can impact your credit in the short term, but for those stuck in high-APR cycles, settling for less than the full balance can be a way to reset.

The bottom line

A 29.99% APR is objectively high for a credit card, even in today’s market. At that level, interest isn’t just an inconvenience; it’s a real barrier to getting ahead. The good news is, though, that high APRs aren’t unmanageable. Between negotiating, restructuring your payments and exploring debt relief options when things feel tight, there are ways to take back control. And, the sooner you tackle the rate, the sooner your money starts moving you forward.

You may be interested

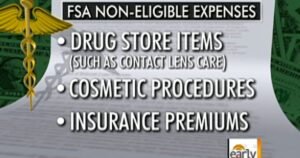

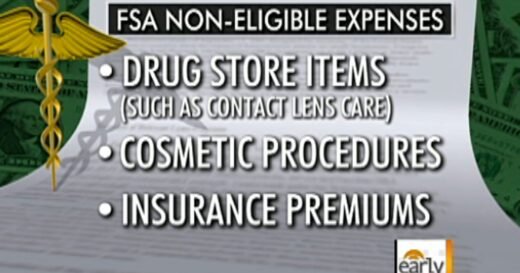

Flex Spending: How to use it and not lose it

new admin - Feb 06, 2026Flex Spending: How to use it and not lose it - CBS News Watch CBS News How can you get…

‘Highly underrated’ comedy starring two Oscar winners streaming now on Netflix | Films | Entertainment

new admin - Feb 06, 2026A "highly underrated" comedy drama starring two Hollywood legends is streaming now in the UK. Heartburn (1986) tells the story…

Luigi Mangione has outburst in court as judge sets June state trial date

new admin - Feb 06, 2026The judge in Luigi Mangione's state trial set a June 8 trial date for New York's case against him for…