California man says he learned his identity was stolen when Uber sent him tax forms for money he didn’t earn

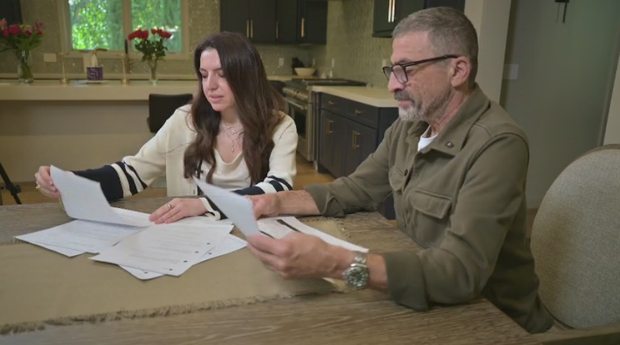

A San Fernando Valley couple says an Uber driver stole the husband’s identity to sign up for the ride-sharing platform, raising questions about public safety and how thoroughly drivers are vetted.

Vahik Tatoosi and his wife first learned of the alleged identity theft in September 2025, when they received a packet in the mail welcoming Tatoosi as a new Uber driver. The problem, they said, is that no one in their household has ever driven for Uber.

“At first, we laughed it off, like, ‘What is this?'” Tatoosi said. “Then we became concerned.”

The couple tried contacting Uber but said reaching a live representative was nearly impossible. They were eventually able to communicate through the Uber app and were told the issue had been escalated to the appropriate support team.

CBS LA

The matter resurfaced last month when the couple received two IRS 1099 tax forms indicating that someone had earned thousands of dollars working for Uber using Tatoosi’s name and Social Security number.

“This is scary,” Tatoosi said. “It’s your identity.”

Tatoosi’s wife, Anna Kojoyan, said the situation goes beyond identity theft and raises serious public safety questions.

“I thought this is a serious matter, not just for identity theft but for public safety as well,” Kojoyan said. “People, young women, kids, teenagers, they use Uber thinking that all drivers are background-checked. But apparently you never know who’s picking you up.”

According to Uber’s website, the company uses third-party vendors to conduct background checks. Prospective drivers must submit a Social Security number, full name, date of birth, government-issued identification and a live profile photo before being approved to drive.

Eva Velasquez, president and CEO of the Identity Theft Resource Center, said cases like Tatoosi’s are an example of employment identity theft, a growing problem nationwide.

“This is a form of employment identity theft or misuse,” Velasquez said. “We have to understand that our data is out there. It’s in the wild.”

Velasquez said the rise of remote and app-based work has made it easier for criminals to impersonate others, especially when employers and workers never meet in person.

CBS LA

“Your Social Security number and other personal information can be used for employment purposes,” she said. “That’s certainly the case with Uber.”

The issue has surfaced in other cases. In 2024, a Kern County man sued Uber after receiving a tax form showing $53,000 in earnings from the company, despite never having worked for it. The lawsuit alleged it took a year to resolve the matter with the IRS and claimed Uber “routinely allows individuals to work for it as a rideshare or delivery driver using the personal information of other individuals.”

Uber declined a CBS LA request for an on-camera interview but said in a statement that it has escalated Tatoosi’s complaint.

“The methods of scamming and defrauding companies are constantly evolving,” the company said. “At Uber, we’re committed to investing in robust anti-fraud systems and detection capabilities to keep up with new and enhanced fraud techniques.”

The Identity Theft Resource Center recommends that consumers obtain an IRS identity protection PIN, create a “my Social Security” account with the Social Security Administration and monitor it regularly. Anyone who believes they are a victim of employment fraud should immediately contact the IRS and file a fraud report.

Tatoosi and his wife said they have frozen their credit and enrolled in a credit-monitoring service. They are now working with the IRS to address the fraudulent income reported under Tatoosi’s name.

“The income is being reported under our name,” Kojoyan said. “Now we have to contact the IRS and let them know what’s going on, because they’re going to expect us to pay taxes on it.”

Uber said it uses a multi-level fraud detection process and re-screens drivers annually.

You may be interested

How some Americans are turning to private firms to flee the war zone

new admin - Mar 05, 2026IE 11 is not supported. For an optimal experience visit our site on another browser.Now PlayingHow some Americans are turning…

Keith Olbermann sparks outrage with social media attack on Lou Holtz

new admin - Mar 05, 2026[ad_1] NEWYou can now listen to Fox News articles! Former ESPN broadcaster Keith Olbermann once again incited backlash on social…

Rep. Tony Gonzales admits to affair with former staffer, calling it a “lapse in judgment”

new admin - Mar 05, 2026Republican Rep. Tony Gonzales of Texas acknowledged for the first time Wednesday that he had a relationship with a former…