Average tax refund is nearly 11% higher so far this year, IRS data shows

Early tax filers are enjoying bigger refunds compared to the same time last year, according to the latest figures from the Internal Revenue Service.

As of Feb. 6, 2026, tax refunds averaged $2,290, up nearly 11% from the same point last year. “Average refund amounts are strong,” the IRS said in a statement last week.

Forecasters have predicted filers would benefit from larger checks this year due to a series of new tax provisions included in the “one big, beautiful” bill signed by President Trump in July. One financial services firm, Piper Sandler, estimated the average payment would increase by about $1,000 per filer.

The biggest benefits are likely to flow to those in the top 10% of households, experts have said. Lower-earning taxpayers will also see gains, but they aren’t as likely to enjoy as big a jump in refund amounts as higher-income households, according to a Jan. 30 analysis from investment firm Principal Asset Management.

Tax season officially kicked off on Jan. 26, 2026. As of early February, the IRS has received nearly 22.4 million returns, slightly down from 23.6 million the same time last year, the agency’s data shows.

People who file electronically usually get their refunds in fewer than 21 days, according to the IRS.

Refund sizes likely to expand

Refunds will likely grow in size as tax season progresses. That’s in part because lower-income Americans tend to file early, while wealthier households, which have more complex tax returns, take longer to file.

The average refund amount typically starts small, peaks in mid-February and then slips slightly through the end of tax season, Andrew Lautz, director of tax policy for the Bipartisan Policy Center, a Washington, D.C.-based think tank, said in a policy brief last month. Last year, the average refund was $2,939, according to the Bipartisan Policy Center.

The IRS typically releases a fresh batch of data each week during tax season and provides a few subsequent updates after filing concludes on April 15.

The agency said it expects refund numbers to be higher when it posts an update on Feb. 27. That’s because by that point, the agency will have processed some of the refunds of Americans who claimed the Earned Income Tax Credit and Additional Child Tax Credit, refundable tax credits designed for low- to moderate-income working families.

You may be interested

‘Masterpiece’ sci-fi thriller hailed as ‘best movie of all time’ arrives on Netflix | Films | Entertainment

new admin - Feb 16, 2026A sci-fi film directed by Ridley Scott that's hailed by fans as a "masterpiece" is streaming now in the UK.…

Police respond to a shooting at high school hockey game in Pawtucket, Rhode Island

new admin - Feb 16, 202615m ago Providence Country Day says its students and staff are safe Kevin Folan, the head of schools at…

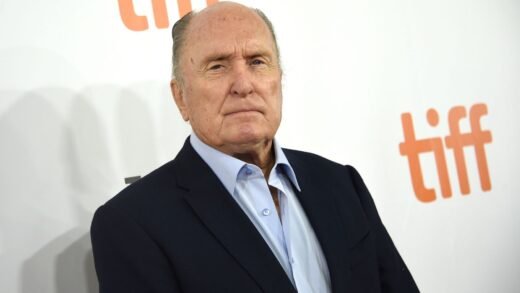

Hollywood legend Robert Duvall, star of Apocalypse Now and The Godfather star, dies aged 95 | Ents & Arts News

new admin - Feb 16, 2026Hollywood icon Robert Duvall, star of films including The Godfather and Apocalypse Now, has died at the age of 95.The…