Quicken Business and Personal vs. QuickBooks

Weiquan Lin/Getty Images

It’s the time of year when many small-business owners, freelancers and side hustlers start thinking seriously about their finances. Whether you are closing the books for the year or mapping out next year’s income goals, though, the right software can make a big difference in how organized and confident you feel. From tracking expenses to preparing for tax season, a financial management tool can either simplify your workflow or add unnecessary complexity.

Two of the most recognized names in this space are Quicken Business & Personal and QuickBooks. While the names may seem similar at first glance, each platform is built with different users in mind. As a result, the features, pricing and depth of capabilities vary widely, and those differences can dramatically affect your day-to-day experience. What works perfectly for a freelancer may not be enough for a growing business, after all, just as what serves a more complex business might overwhelm someone managing only a handful of invoices each month.

In turn, choosing between the two ultimately comes down to understanding not only what each platform offers but how those features align with your needs. Below is a detailed breakdown to help you make an informed decision.

Find out how to get started with the right Quicken platform now.

Quicken Business and Personal vs. QuickBooks

Before reviewing each category, it is important to recognize the primary distinction between the two platforms: Quicken Business & Personal is a personal finance tool with added business features, while QuickBooks is a comprehensive business accounting system. This foundational difference impacts every aspect of how the software functions. So, how do the two compare in each category? Here’s what we found:

Overall purpose and use cases

Quicken Business & Personal is designed for those who want to manage both personal finances and small-scale business activities within a single platform. It works particularly well for freelancers, sole proprietors, landlords and people with side gigs who need basic business functionality but do not require the level of financial detail that a full accounting system provides. Because Quicken integrates budgeting, bill tracking and investment monitoring alongside business ledgers, it may appeal most to users who want to see their entire financial picture in one environment.

QuickBooks, on the other hand, is intended for business owners who need a powerful, professional accounting system. It is built to support operations with more complex requirements, including payroll, inventory tracking, multi-user access, detailed financial reporting and integrations with other business tools. As a result, QuickBooks is generally better suited for businesses that are growing, hiring employees or handling a high volume of transactions. Its design prioritizes accuracy, scalability and compliance, which makes it a standard choice for companies that need robust bookkeeping capabilities.

Compare your Quicken options and find the right fit today.

Accounting and financial management tools

Quicken Business & Personal provides a strong foundation for managing income and expenses, offering separate ledgers for personal and business categories and allowing users to track cash flow across different activities. The platform includes simple invoicing tools, payment tracking, profit-and-loss summaries and receipt organization. For many users, these features are more than enough to stay organized throughout the year. However, Quicken does not support double-entry accounting or advanced reconciliation features.

In contrast, QuickBooks delivers a full suite of accounting tools designed to handle even complex financial needs. It supports double-entry accounting, detailed accounts receivable and accounts payable workflows, customizable financial statements, cash-flow projections and extensive reporting tools that allow business owners to analyze performance from multiple angles. These features make QuickBooks a comprehensive solution for those who require reliable, business-grade financial management.

Payroll, taxes and business compliance

Quicken Business & Personal offers basic tax categorization tools that make it easier to prepare information for tax filing, but it does not include payroll capabilities. Users who need to pay employees or manage withholding requirements must rely on separate services for these tasks. While Quicken can help keep records organized, it does not serve as a substitute for payroll or tax management software.

QuickBooks, on the other hand, includes integrated payroll options that allow businesses to manage employee wages, benefits and tax withholdings directly through the platform. It also includes features that support sales tax management, contractor payments and other compliance-related tasks. These built-in capabilities help streamline operations for businesses that must meet ongoing regulatory requirements.

Invoicing and payments

Quicken Business & Personal supports straightforward invoicing with templates that cover most basic needs. Users can create and send invoices, record payments and monitor outstanding balances. For freelancers and small operators who send a modest number of invoices each month, these features are more than sufficient and integrate smoothly with the rest of Quicken’s budgeting and tracking tools.

QuickBooks offers more advanced invoicing capabilities, including recurring invoices, automated reminders and support for a variety of payment methods, such as credit cards and ACH transfers. Businesses can also integrate their invoicing with e-commerce platforms or other applications, making QuickBooks more useful for organizations that generate significant or ongoing billing activity.

Inventory and product management

Quicken Business & Personal does not offer built-in inventory tracking. Users who manage physical products must rely on manual categorization or separate tools outside the platform.

QuickBooks includes detailed inventory management features that allow businesses to track product quantities, monitor cost of goods sold and set reorder points. These tools are crucial for retail, manufacturing or product-based businesses and contribute to QuickBooks’ reputation as an all-in-one accounting solution.

Personal finance features

Quicken Business & Personal distinguishes itself with its comprehensive suite of personal finance tools. Users can build budgets, track debt balances, monitor investments, set savings goals and manage recurring bills. These capabilities allow users to view their financial lives holistically, ensuring that business decisions align with personal financial goals.

QuickBooks, however, does not offer personal finance features. It is designed exclusively for business purposes, which limits its usefulness for those who want a single platform to manage all aspects of their financial lives.

Ease of use

Quicken Business & Personal is known for its accessible, easy-to-navigate interface. The platform focuses on simplicity, which makes it appealing to users who prefer intuitive tools without extensive technical requirements. Its learning curve is minimal compared to full accounting systems.

QuickBooks, while powerful, requires more time to learn. Its depth and complexity make it the preferred choice for accountants and experienced business owners, but it can be overwhelming for those who are new to bookkeeping or who do not need such advanced features.

Pricing

Quicken Business & Personal is generally much more affordable than QuickBooks, with annual subscription pricing that often comes in significantly lower than QuickBooks’ monthly subscription tiers. This pricing difference makes Quicken an attractive option for cost-conscious individuals who need only light business functionality.

QuickBooks’ pricing reflects its more sophisticated capabilities. Costs can increase quickly for users who need payroll, additional seats or integrations, but the value may be worth it for businesses that rely on these features.

The bottom line

Quicken Business & Personal is an excellent choice for individuals who want to manage both personal and small-business finances in one place. QuickBooks, in contrast, is the superior option for businesses that require a comprehensive accounting system. Ultimately, though, these two platforms cater to different users, and the right choice depends heavily on the nature of your work. If you want simplicity and broad visibility across your personal and business finances, Quicken Business & Personal may be the ideal fit. If your priority is scalable and professional-grade business accounting, QuickBooks is likely to offer the tools and structure you need to operate confidently.

You may be interested

Mariah Carey Awarded Sanctions in ‘All I Want For Christmas’ Lawsuit

new admin - Dec 24, 2025[ad_1] A judge found that Carey incurred "needless expenses responding to frivolous legal arguments" made by country artist Andy Stone,…

How to watch Christmas Day NFL games

new admin - Dec 24, 2025[ad_1] NEWYou can now listen to Fox News articles! It’s unbelievable that there are only two weeks left in the…

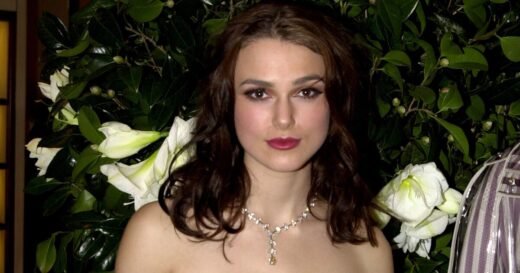

Love Actually fans torn over ‘cowardly’ Keira Knightley bit | Films | Entertainment

new admin - Dec 24, 2025Fans of Love Actually have been debating the controversial cue card scene between screen legends Keira Knightley and Andrew Lincoln.…